Was Squid Game 2 Inspired by the Real-Life SQUID Crypto Scam?

How South Korea focussed on a crypto narrative in it's latest season... [potential spoilers]

Player 333 is a character in the Netflix series Squid Game 2, which was released last week worldwide. If you’ve been living under a rock, the series is one of both South Korea’s and Netflix’s biggest television triumphs and revolves around a game. Players are taken to an isolated island and forced to fight to the death through childhood games with other contestants for a cash prize.

How crypto features.

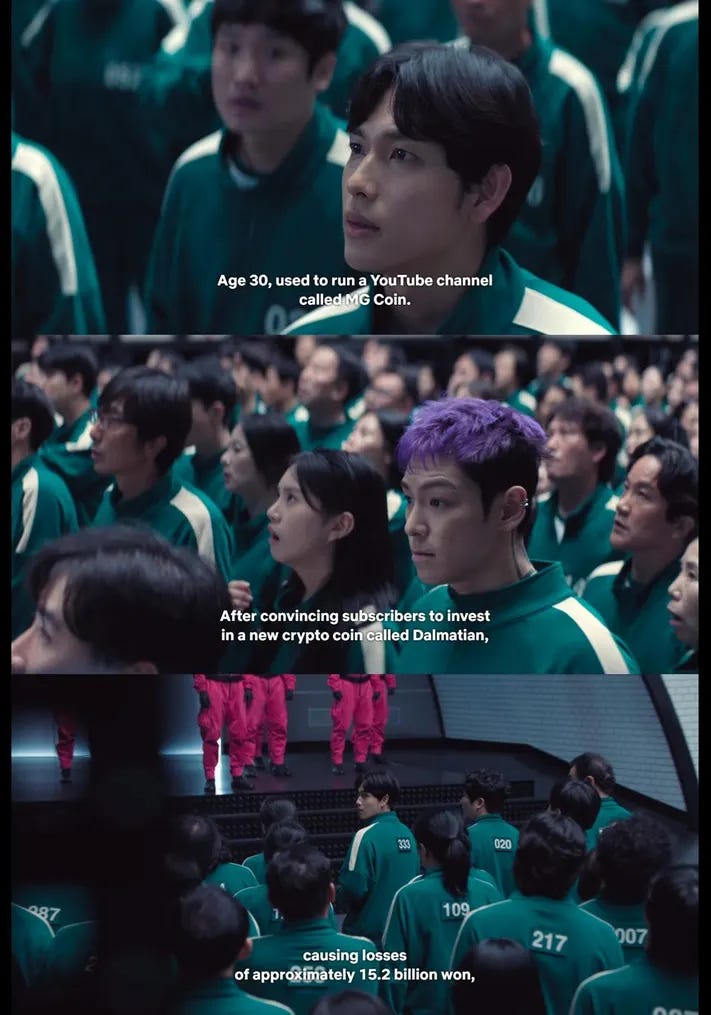

Each player has a backstory that explains what has led them to the desperation to enter the games. Interestingly, Player 333 (Lee Myung-gi)’s backstory is that of an alleged crypto scammer who rug-pulled his huge follower base, causing his subscribers to lose 15.2 billion won, including two other Squid Game players he found himself locked in with.

Lee Myung-gi was a YouTuber who ran a channel called MG Coin. Mirroring the life of what’s commonly called a “KOL” or “Key Opinion Leader,” a large part of their job is often to either publicly support or “FUD” crypto projects. Like Instagram influencers, what they say and encourage their followers to do can have a huge impact on the success of a project.

The real life ‘Squid Coin’ scam.

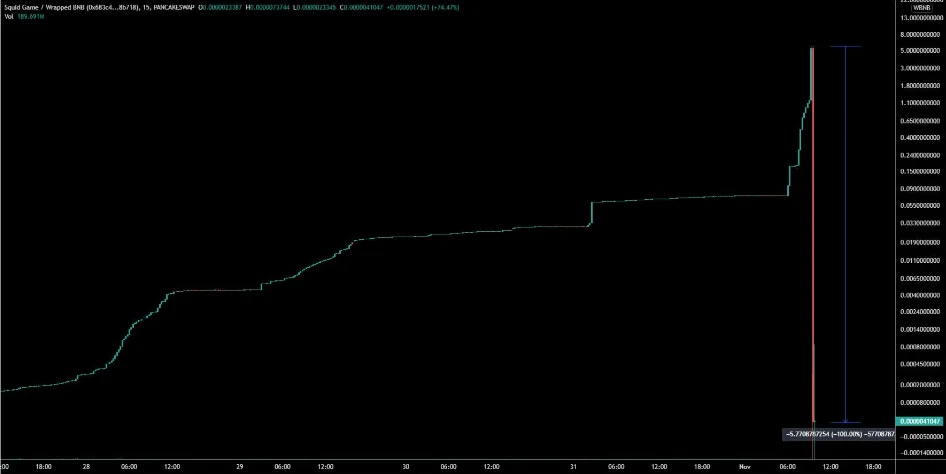

Many are rumouring that this story was inspired by true events from the ‘SQUID’ crypto scam that took place in 2021 and producers were sending out a message. This coin was called SQUID coin and promised to run a 'play-to-earn scheme. Taking advantage of the shows notoriety, the coin quickly grew in popularity until the valuation was $2800+.

What was the promised utility?

Owners of the tokens were promised to take part in an upcoming online game site inspired by the Squid Games show where token owners could play and earn from games daily.

How were people scammed?

People were scammed in multiple ways. Firstly, the owners of the tokens were unable to cash out as they had been promised. Additionally, the original developers of the coin quickly cashed out their holdings in a matter of minutes, completely draining all liquidity from the exchange. This left the token owners with worthless assets. It is said that the project owners/developers left with $3.38 million…

Common of a crypto scam, all trace of their online presence suddenly disappeared too. This is when developers of the project delete the official Twitter profile, website and any other public marketing material so people are unable to trace it back to them. Crypto scams, for the most part, are more obvious to identify and share once they’re done because the transactions are public. What is more difficult, however, is for anti-fraud companies to trace and track where these funds have gone and which wallets are owned or connected to specific users.

Below is a screenshot taken from the charts. You can immediately see the drop off which was a clear ‘rug pull’.

History repeating itself?

Just hours after the S2 release in December, multiple memecoins flooded the market trying to convince the new wave of watchers to invest in SQUID tokens. Tokens inspired by the S2 drop grew across two blockchains, Solana and BASE. Viewers of these new coins have flagged them as potential scams because they detected the top % of holders of the token all looked the same. This is a tactic that many people look at when thinking of investing in a certain token. If the top % of the coin is owned by the same wallet or the same user owning multiple wallets, they could remove all of their tokens in minutes, dragging the value down drastically due to the dangerously concentrated ownership amount. Learn what to look out for on Cointelegraph here.

Beyond the scandals: steering crypto to a better narrative.

Whilst this may seem an exciting signal that cryptocurrencies are becoming more mainstream, it also sends out dangerous precedent that whenever the word crypto is heard so is the word scam. Whilst it makes for interesting storylines, the world of cryptocurrencies are so much more than just scams.

One reason crypto scams gain so much attention is the ‘unknown’. The unknown of how law and enforcement will be able to respond due to the regulatory wild west, and the unknown of crypto itself makes it all the more mysterious. The sensationalism that comes from click-worthy scam stories could be permanently harming the public ‘image’ of crypto.